|

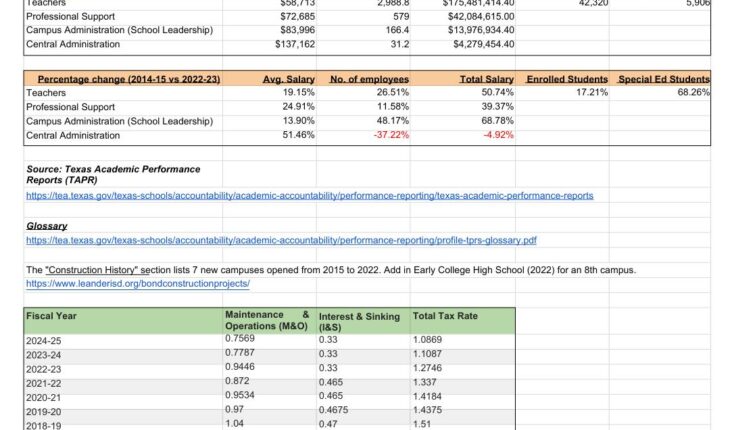

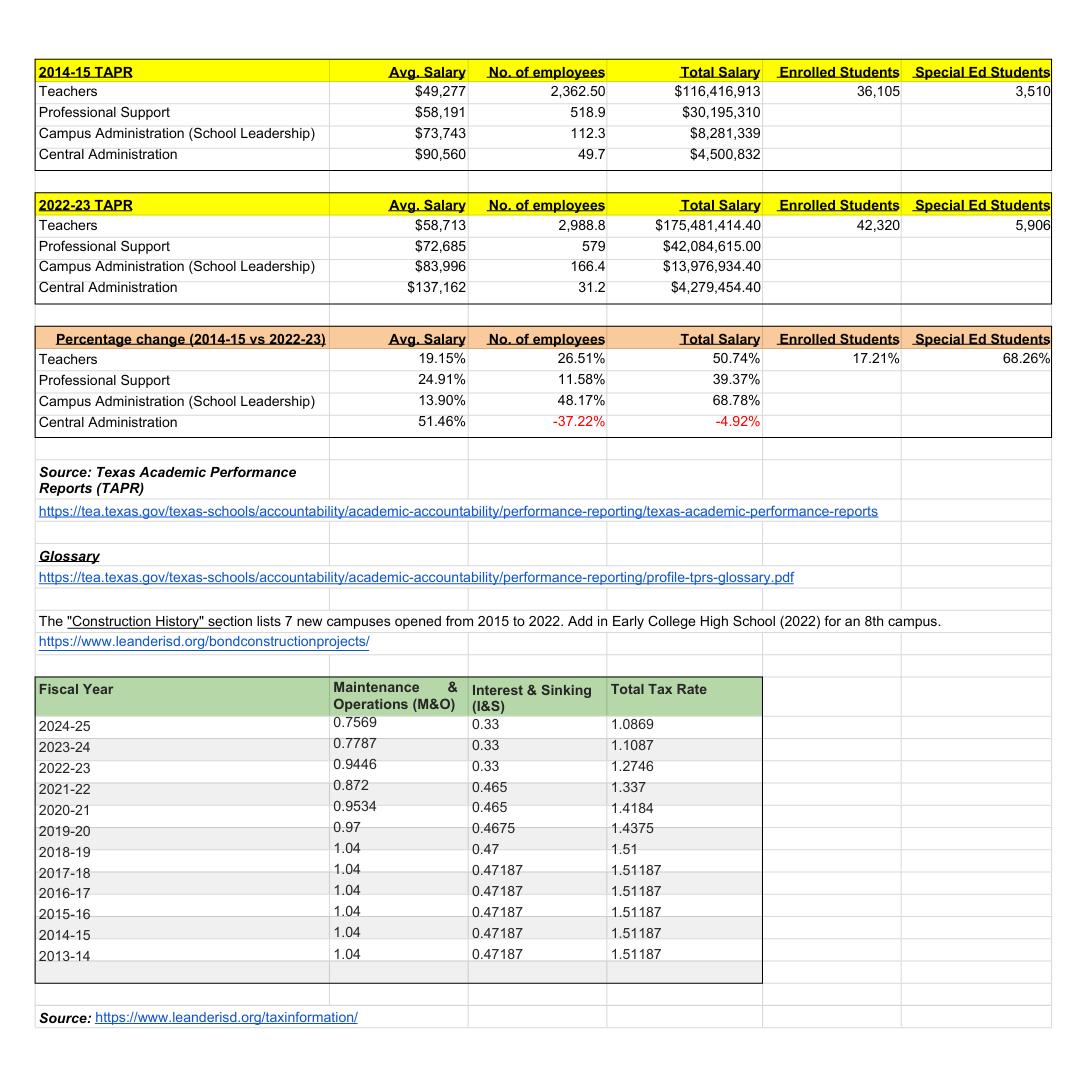

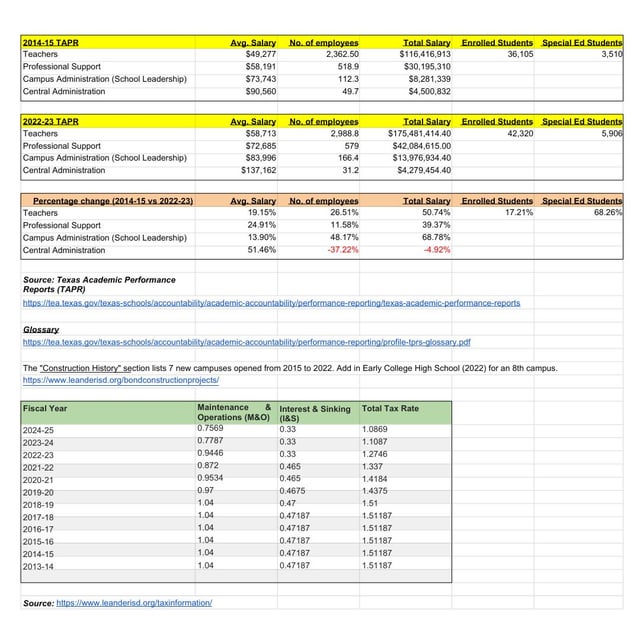

As a trustee, it is important to understand the different dimensions of information that data provides. It’s also necessary to cite credible references to provide the community with transparent, accurate, reliable information. Engaging with voters, I have been often asked about “rising admin costs” and “increased taxes.” These have been opportunities for me to share TAPR information and tax rate information from government sources. My compilation shows that costs are being directed to the classroom, central admin has shrunk, and tax rates have declined every year since 2019-2020 – a 24% decrease! It also shows that while enrollment has increased at 17%, the need to provide special education services has increased by 68%. There are other dimensions in the reports, but I will call out only these two for simplicity sake. School districts are subject to a complex formula to determine how much of the property taxes they get to keep or return to the state. The formula starts with the basic allotment per student, currently at $6,160 if they have perfect attendance, which remains unchanged since 2019. The special education allotment has also been stagnant for over 30 years in the face of increased student needs. The past fiscal year, Leander ISD had to spend $25m above what the state provides to try to meet the needs of the special education students. The state has issued numerous underfunded/unfunded mandates that the district has to absorb. The county appraisal districts set the property valuations and the legislature has a floor (Maximum Compressed Rate / MCR) on how low school districts can set the M&O rate. We are at the MCR (plus pennies from the VATRE), so we cannot go lower on M&O. The combination of lower tax rates (set by the board) and increased homestead exemptions (by the legislature and voters) have helped reduce property taxes in the face of increased county appraisals. There is still work being done to help with cost containment and operational efficiency. Every $3m saved translates to a 1% salary increase for teachers. This is why it is critical that trustees understand the different dimensions of data analysis and Texas school finance system, and advocate that the legislature fully funds public education. The people failing public education are our state legislators who want to pass vouchers, which will divert much-needed public funds to private entities. Public education is always on the ballot from the top to the bottom. Vote wisely! https://docs.google.com/spreadsheets/d/19NH2DZpGRfNNsP8yvuktDmBZuVzzB96XHMl51NGHc-k/ submitted by /u/SadeForLISD |