For retail operators, it’s been a tough 12 months. Years of sticker shock have pushed shoppers to be discerning — some would say fickle. Freight costs that leveled in 2023 significantly rose once more due to disruptions in the Red Sea, placing pressure on margins. High interest rates meant that there was less available capital to invest in growth and dealmaking.

But the strongest players have prevailed against these odds, proving that a focus on profitability and a disciplined approach to driving sales are key to sustaining a healthy business. For instance, retailers such as Aritzia and Uniqlo have demonstrated that stores aren’t just billboards for brands; they can generate lucrative sales through compelling merchandising and decent customer service. Struggling retailers like H&M, Gap Inc. and Macy’s have all anchored their turnarounds on similar strategies.

One thing is for sure: Fashion is resilient. Physical retail is thriving again, with a new generation of independent stores at its forefront. And even without a physical footprint, the smallest labels are finding creative ways to reach their customers in real life, from collaborations with unlikely partners to doubling down on niche curation.

Top Stories

Case Study | The Art and Science of Retail Store Success: The best stores don’t just serve as billboards or customer touchpoints — they’re a stable and lucrative revenue stream. As younger consumers have embraced in-store shopping despite their digital native instincts, the value of stores is undeniable. Running an effective store requires choosing the right location, understanding its sales potential and making sure it serves its local clientele.

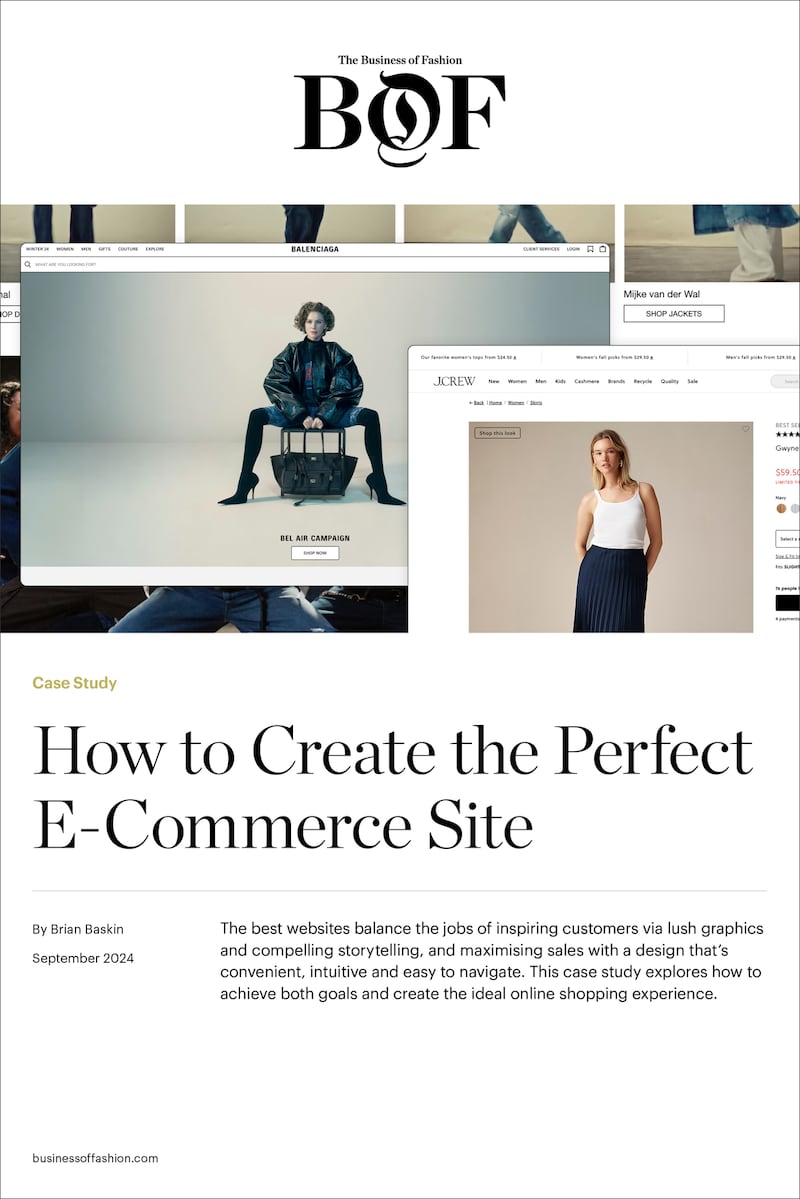

Case Study | How to Create the Perfect E-Commerce Site: The best stores don’t just serve as billboards or customer touchpoints — they’re a stable and lucrative revenue stream. As younger consumers have embraced in-store shopping despite their digital native instincts, the value of stores is undeniable. Running an effective store requires choosing the right location, understanding its sales potential and making sure it serves its local clientele.

How to Reach Shoppers When They’re Not in the Mood to Shop: As savings dwindle and credit card debt soars, the American consumer’s famed resilience is starting to show some cracks. Brands and retailers would be wise to take a more sensitive approach to courting them.

Innovation Won’t Save Department Stores. The Right Products Will.: Mid-market American department stores like Macy’s, Kohl’s and Nordstrom need more than new owners and retail formats to win back customers; they must reinvent their entire value proposition with a selection that can compete with online fast fashion and off-price players. Time is running out.

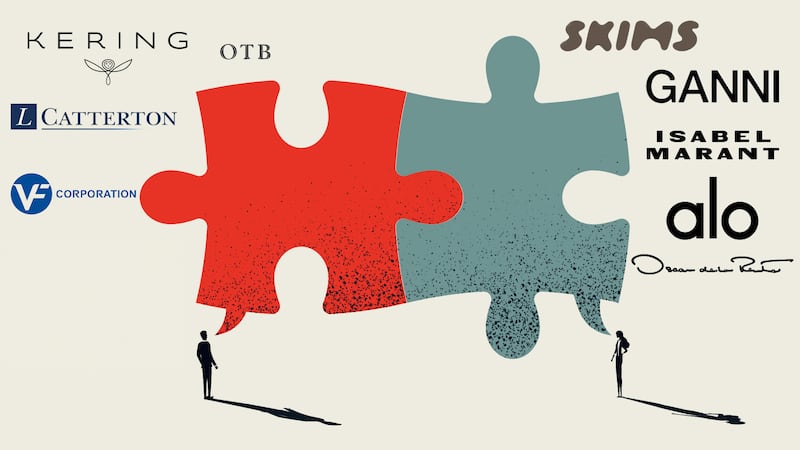

What a Fashion Company Is Worth Today: In an era of austerity on Wall Street, apparel businesses are more likely to be valued on their profits rather than sales, which usually means lower payouts for founders and investors. That is, if they can find a buyer in the first place.

H&M’s Big Bet on Fashion’s Elusive Middle: In an exclusive interview, CEO Daniel Ervér outlined his strategy to turn the Swedish fast-fashion giant’s greatest weakness — its positioning above Shein but below Zara in the category’s pricing hierarchy — into a strength. It all kicks off with a collection launching next month.

The Stores Defining a New Era of Multi-Brand Retail: As department stores and online giants struggle, a new generation of independent boutiques are carving out their own path for success. Often that means eschewing easy online sales, investing in brick-and-mortar offerings and taking a chance on emerging labels.

The Glory Days of the Pop-Up Store Are Over. What’s Next?: Rising rents and low vacancy rates have made it prohibitively expensive for many emerging brands to open retail locations — even temporary ones. Scrappy companies have found creative, low-cost ways to reach their consumers, from hotel partnerships and trunk shows to activations on college campuses.

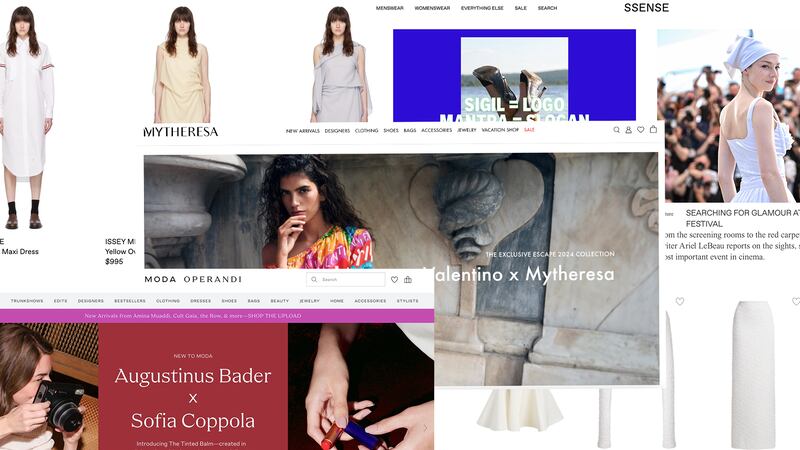

Luxury E-Commerce: Who’s Surviving and Why: Experts say Mytheresa, Ssense and Moda Operandi have kept afloat in a challenged space by honing in on a particular consumer, curating their assortments and executing on retail basics. Still, the road ahead is tough, and the bigger they get, the harder it will be to sustain these strategies.

Nike, Lululemon and Activewear’s Innovation Problem: The category’s biggest brands by market capitalisation report results this week, and will need to show they have a plan to fend off fast-growing competition.